As we wait to see if the recent bounce was an interest-rate induced pull forward of demand or a new up-leg, it is time to review our premise that we are in a bubble.

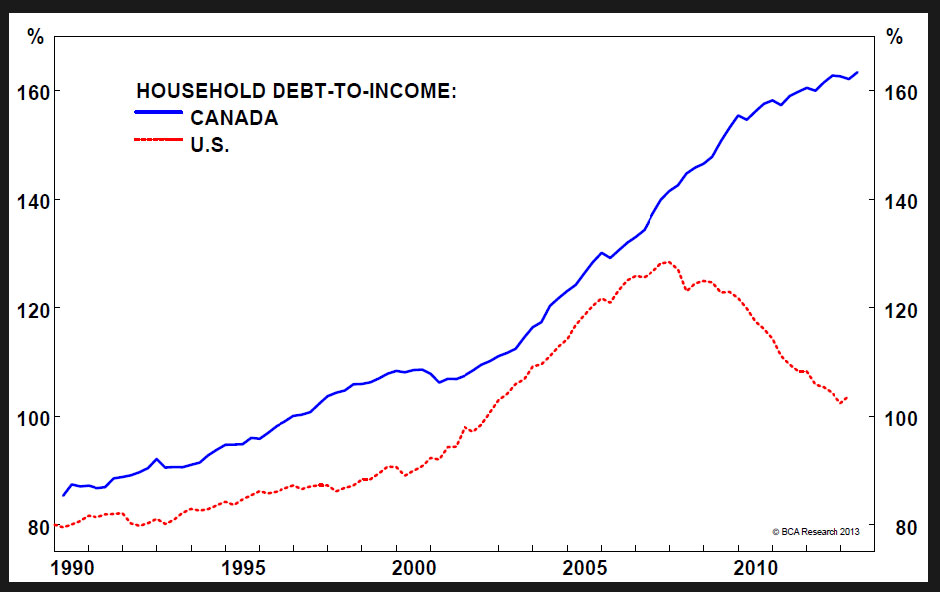

We have been over the exploding debt situation, the huge discrepancy between income, rental return and prices which is the basis for the bubble call. There is no point me reviewing them, suffice it to say we are near extremes in all these measure. Numbers which look even worse with the market driven rate rises (no action from the Bank of Canada needed), and now the CMHC pull back.

In fact since 2010, we have had a number of changes by the Federal Government designed to take RE off the boil and prices have withstood all this very well.

Will it continue or will we have a 'Wiley Coyote" moment as David Madani says.

On the other hand we have the bulls who point to places like Hong Kong, where finite supply and enormous demand from Mainland China have sent prices into the stratosphere. This is despite nearly a dozen initiatives from the HK Government trying to cool things down.

In fact they are very well documented in this excellent chart. You can click on it so that you can read the notations.

The HK government has been much more proactive about reigning in prices. Short of banning sales to Mainland Chinese, which they cannot do, they have done everything else. These include:

Forcing banks to stress test borrowers.

Dropping the loan to value to 60% for properties over about $900K (it was $1.7M before)

Increasing the property transfer tax to 4.25% for properties over $1.7M

Tightening up presales and putting penalties on both sides if they cancel.

Compared to Hong Kong, we are still in easy street, despite Mr Flaherty's changes (which were really a reversal of previous mistakes).

HK prices prices have gone up and up, pushing aside the Government road blocks like so many flies. The wall of money from China pours in through over dyke pricing out locals.

As you can see corrections were countered by the actions of another Government, Quantitative Easing by the US Fed which has poured money into the system (I won't go into how few people have benefitted from this action at this time, but will keep that for another tirade) as well as Chinese government liquidity drives (not shown) and those who can access cheap money will push up assets.

What does this tell us? That bubbles have a mind and a momentum of their own.

You will also note that Government action, even in Hong Kong, did not start until housing had increased 80% off the bottom in just a few years, and Hong Kong is one of the more sensible jurisdictions.

Government action to reign in bubbles ALWAYS comes too little and too late. When things are going up, everyone is happy and the groups benefitting the most become active in the political process to prevent any action to curtail things. It is only when it is obvious to any fool that we have entered a fantasy of valuation does Government act, usually with little effect.

Look at the graph again and you can contrast the actions of the HK government when prices started collapsing from their last bubble. Only a 30% drop brought action to bolster prices (in green). And yet they had very little effect on the way down too!

The bubble burst had to run it's course and went on and down for 5.5 years despite nearly a dozen pro-RE actions.

Bubbles will implode when they implode. After the fact people will try and look for the cause. A particular event or action or some change in fundamentals. None of these are usually the case. It is just a case of a sudden change of mass psychology and a run for the exits.

Look at Gold the general wisdom is that Gold has been dropping due to the Fed talking about tapering QE. However if you look at the chart , you will see that the collapse started a few months BEFORE the FEd announced tapering.

Now while I do believe the Fed's main role under Greenspan and Bernanke has been to keep profits at the Wall Street casinos healthy and some pre-warning is not unlikely, this still does not explain a drop that started due to a sudden drying up of demand. It happened because it happened.

So when our bubble bursts, we should be alert for the 'causation experts'. RE representatives, bank economists etc who will try and blame the drop on the CMHC changes or some other Government action that needs to be reversed quickly - so that we can hold them to account in public.

1) No one action leads to a bubble bursting

2) The actions of Government are always too little and too late, on the way up and down.

3) No industry has the right to jeopardize the financial well-being of a country and future generations. It is my contention (and that of many smarter than me) that the CMHC has done just that, by increasing our obligation to $600 Billion and help fan the fires of prices. The next generation has enough to contend with carrying the debt of baby-boomer entitlements without having to deal even more obligations and even more expensive housing.

Finally it is good to end with Galbraith, the pre-eminent bubble economist dissector, who was quoted in Hussman's article today

Decades ago, in his narrative A Short History of Financial Euphoria economic historian J.K. Galbraith lamented the “extreme brevity of the financial memory.” He wrote, “In consequence, financial disaster is quickly forgotten.

In further consequence, when the same or closely similar circumstances occur again, sometimes in only a few years, they are hailed by an always supremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.”

(Think Nortel and RIMM shares hitting the stratosphere. Think shoe-box sized Condos selling for $600K or crack-shacks unfit for human occupation selling for over $1 Million Dollars.)

“There is protection only in a clear perception of the characteristics common to these flights into what must conservatively be described as mass insanity. Only then is the investor warned and saved. In the short run, it will be said to be an attack, motivated by either deficient understanding or uncontrolled envy, of the wonderful process of enrichment.”

“Speculation building on itself provides its own momentum. This process, once it is recognized, is clearly evident, and especially so after the fact. So also, if more subjectively, are the basic attitudes of the participants. These take two forms.

There are those who are persuaded that some new price-enhancing circumstance is in control, and they expect the market to stay up and go up, perhaps indefinitely. It is adjusting to a new situation, a new world of greatly, even infinitely increasing returns and resulting values. Then there are those, superficially more astute and generally fewer in number, who perceive or believe themselves to perceive the speculative mood of the moment.

They are in to ride the upward wave; their particular genius, they are convinced, will allow them to get out before the speculation runs its course. They will get the maximum reward from the increase as it continues; they will be out before the eventual fall.

“For built into this situation is the eventual and inevitable fall. Built in also is the circumstance that it cannot come gently or gradually. When it comes, it bears the grim face of disaster. That is because both of the groups of participants in the speculative situation are programmed for sudden efforts at escape. Something, it matters little what – although it will always be much debated – triggers the ultimate reversal.”

.